WhatsApp)

WhatsApp)

2014 Assore Limited . Industrial plant, machinery and equipment is depreciated on the straightline basis, over its useful life, up to a maximum of 25 years Vehicles Vehicles are depreciated on the straightline basis The annual depreciation rates used vary between five and nine years Furniture and fittings Furniture and fittings are depreciated on the straightline basis The annual depreciation ...

Jan 01, 2019· Accounting Intermediate Accounting: Reporting And Analysis On January 1, 2019, Barbosa Company purchased a coal mining site for 1,000,000. Under the terms of the purchase agreement, Barbosa must restore the site to specified conditions at an estimated cost of 125,000. Barbosa estimates that it will be able to operate the site for 20 years.

May 27, 2020· Depreciation rates as per income tax act for the financial years 201516 201617 are given below. A list of commonly used depreciation rates is given in a ... (thermal efficiency higher than 75 per cent in case of coal fired and 80 per cent in case of oil/gas fired boilers) ... E. Electrical equipment:(a) ...

The coal in the mine would be exhausted after 15 years. The equipment would be sold for its salvage value of 250,000 at the end of 15year period. The company uses straight line method of depreciation and does not take into account the salvage value for computing depreciation for tax purpose.

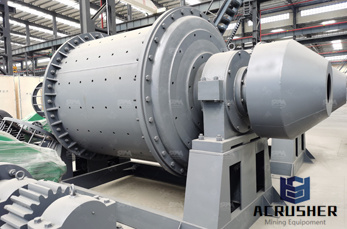

Plant and Equipment places more emphasis than GAAP on a "component" approach to depreciation, under which costs are allocated to "significant parts" of an asset and each part is separately depreciated. For example, large components of a mill that wear out at a separate rate from the mill as a whole would be separately depreciated.

Compute depletion and depreciation on the mine and mining equipment for 2011 and 2012. The units ofproduction method is used to calculate depreciation. 2. Discuss the accounting treatment of the depletion and depreciation on the mine and mining equipment. You''ve reached the .

Depreciation Rates Table A ... Coal mining (06000): Coal preparation assets: Centrifuges: 15 years: %: %: 1 Jul 2003: Crushing assets (including feeder breakers, impact, roller and rotary crushers) ... Agriculture, construction and mining heavy machinery and equipment repair and maintenance assets:

The depreciation rate (assumed to be per cent) increases by 2 percentage points to per cent. A higher capital share and depreciation rate both lead to modest increases in our estimate of the longrun mining investment share of GDP, and changes to output growth only have a marginal impact on our results (Graph 7).

The MACRS Asset Life table is derived from Revenue Procedure 8756 19872 CB 674. The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168(a) of the IRC or the alternative depreciation system provided in section 168(g).

Ideal for Accountants BMT Rate Finder is available as an app for your iPhone, iPad or Android devices. Download the BMT Rate Finder app today and search depreciation rates on the go. With more than 1,500 plant and equipment items identified as depreciable assets by the Australian Tax Office (ATO), our app helps to take the guesswork out of calculating the effective life of depreciating assets.

Depreciation Rates For Gold Mining Equipment. depreciation rates for gold mining equipment Gold price touches 6month low as currency war talk heats up depreciation rates for gold mining equipment Fiat currency depreciation increases gold''s allure as a hedge Frik is editor and writer for MINING Frik has worked as a Suppliers and Equipment Dredging Equipment and Supply Dredge .

Depreciation Rates As Per Companies Act Of Coal Crusher. Depreciation rates as per companies act of coal crusher depreciation rates as per companies act of coal crusher read more mobile crusher price indiamobile crushing machine in depreciation rate applicable to crusher units and depreciation how much applicab granite stone quarry in kalimantan indonesia and. Read .

.A depreciation method that allocates depreciation of a plant asset based on the Tax Act of 1989 is the _____ method. Modified Accelerated Cost Recovery The credit portion of the adjustment for the depletion of a coal mine was credited to the Coal Mine account.

Depreciation under Companies Act, 2013. 1 SCHEDULE II 2 (See section 123) USEFUL LIVES TO COMPUTE DEPRECIATION. PART ''A'' 1. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. The depreciable amount of an asset is the cost of an asset or other amount substituted for cost, less its residual value.

mining Financial reporting in the mining industry International Financial Reporting Standards 6th edition

.A depreciation method that allocates depreciation of a plant asset based on the Tax Act of 1989 is the _____ method. Modified Accelerated Cost Recovery The credit portion of the adjustment for the depletion of a coal mine was credited to the Coal Mine account.

Coal mining Coal mining Choosing a mining method: The various methods of mining a coal seam can be classified under two headings, surface mining and underground mining. Surface and underground coal mining are broad activities that incorporate numerous variations in equipment and methods, and the choice of which method to use in extracting a coal seam depends on many .

During the computation of gains and profits from profession or business, taxpayers are allowed to claim depreciation on assets that were acquired and used in their profession or business. The Income Tax Act 1962, has made it mandatory to calculate depreciation. Following are the depreciation rates for different classes of assets.

Depreciation = (cost salvage value)/ capacity in units Units can be measured in units of output (units produced) or units of input ( machine hours) Depreciation Method: Sumofyearsdigits Depreciation is determined by the use of an annual fraction whose denominator will be the same each year but whose numerator will change.

Amortization of certain coal mine safety equipment. § Amortization of certain coal mine safety equipment. (a) Allowance of deduction (1) In general. Under section 187(a), every person, at his election, shall be entitled to a deduction with respect to the amortization of the adjusted basis (for determining gain) of any certified coal mine safety equipment (as defined in § 1 ...

Depletion method of depreciation is mostly used by the companies that have assets that are natural resources like oil, gas, coal, mines, quarries or other wasting assets.. This method is named as ''depletion method'' because the reduction of a natural resource or asset is known as depletion of that resource or asset and thus is used to depreciate assets that are natural resources.

2014 Assore Limited . Industrial plant, machinery and equipment is depreciated on the straightline basis, over its useful life, up to a maximum of 25 years Vehicles Vehicles are depreciated on the straightline basis The annual depreciation rates used vary between five and nine years Furniture and fittings Furniture and fittings are depreciated on the straightline basis The annual depreciation ...

Plant and Equipment places more emphasis than GAAP on a "component" approach to depreciation, under which costs are allocated to "significant parts" of an asset and each part is separately depreciated. For example, large components of a mill that wear out at a separate rate from the mill as a whole would be separately depreciated.

Nov 20, 2019· The millions of dollars saved through depreciation can be used to invest in new mining equipment, to pay for outstanding business costs or even to expand operations. To find out more about depreciation for commercial property, Request a Quote or contact our expert staff on 1300 728 726.

WhatsApp)

WhatsApp)